To say that BlackBerry has hit a

rough patch would be an understatement: they just suffered a 64%

decrease in revenue, which is now clocked in at $976 million.

The once mighty Canadian tech-manufacturer has reported $423 million in losses for Q4 2014, which translates to an 80 cents drop per share.

The biggest factor for BlackBerry's poor market performance is the lack of significant BlackBerry 10 adoption from new users.

In order for the company to stay afloat, they will employ a new management team and implement a lot of cost cuts, so expect jobs to start being slashed throughout the corporation. To bring in revenue, BlackBerry will make government and corporate clients their focus, while also honing in on emerging markets with their low-end offerings.

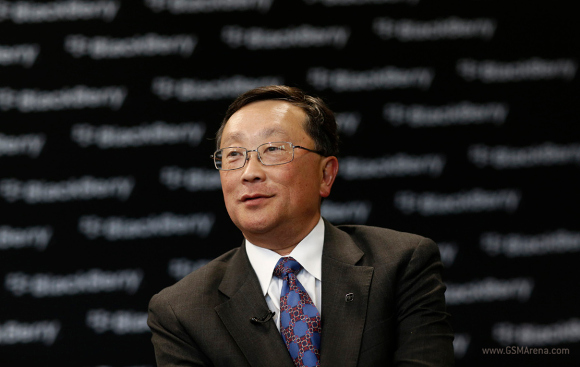

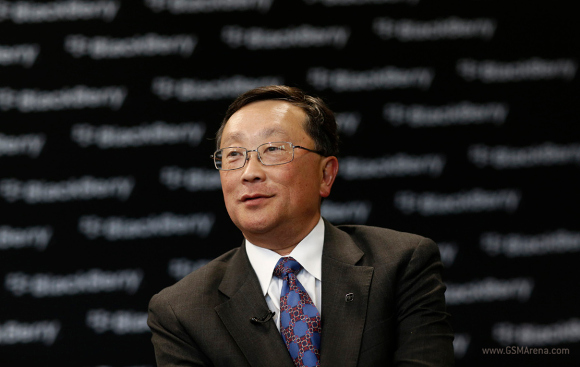

BlackBerry CEO John Chen predicts that the company will be profitable in 2016, and for cash flow to be positive within the next four quarters.

They were able to sell 3.4 million smartphones during the last quarter, but less than a third of these units ran OS 10.

The company is also looking to other methods of generating revenue outside of hardware sales. BBM enjoys a user base of 85 million people, and Chen has revealed some plans of making some money off of them: through sticker sales and sponsored posts.

On the hardware side, BlackBerry is primed to release the Q20, and the Z3. The Z3 is a low-end offering that'll debut in Indonesia. The Q20, or “BlackBerry Classic” is a successor to the Q10, which is aimed at the corporate user.

It's tough to have a positive outlook for BlackBerry. Years ago, the company enjoyed unrivaled market dominance, and then they devolved into a purely corporate solution. However, even that can't be said of them anymore, with iOS and Android devices becoming more and more prominent in the workplace, there are fewer places where BlackBerries are relevant anymore. -- gsmarena.com

The once mighty Canadian tech-manufacturer has reported $423 million in losses for Q4 2014, which translates to an 80 cents drop per share.

The biggest factor for BlackBerry's poor market performance is the lack of significant BlackBerry 10 adoption from new users.

In order for the company to stay afloat, they will employ a new management team and implement a lot of cost cuts, so expect jobs to start being slashed throughout the corporation. To bring in revenue, BlackBerry will make government and corporate clients their focus, while also honing in on emerging markets with their low-end offerings.

BlackBerry CEO John Chen predicts that the company will be profitable in 2016, and for cash flow to be positive within the next four quarters.

They were able to sell 3.4 million smartphones during the last quarter, but less than a third of these units ran OS 10.

The company is also looking to other methods of generating revenue outside of hardware sales. BBM enjoys a user base of 85 million people, and Chen has revealed some plans of making some money off of them: through sticker sales and sponsored posts.

On the hardware side, BlackBerry is primed to release the Q20, and the Z3. The Z3 is a low-end offering that'll debut in Indonesia. The Q20, or “BlackBerry Classic” is a successor to the Q10, which is aimed at the corporate user.

It's tough to have a positive outlook for BlackBerry. Years ago, the company enjoyed unrivaled market dominance, and then they devolved into a purely corporate solution. However, even that can't be said of them anymore, with iOS and Android devices becoming more and more prominent in the workplace, there are fewer places where BlackBerries are relevant anymore. -- gsmarena.com

0 comments:

Post a Comment